PROJECTS |

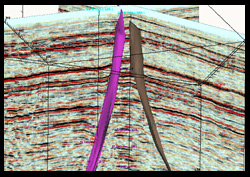

EXPLORATIONFrom the beginning APEX’s development strategy for the Sfax Offshore Exploration Permit was to focus on the evaluation for possible development of three past discoveries. Of the 19 wells drilled to date on the Permit, 3 wells drilled in the 1970’s and 1990’s by previous operators tested oil. A well on the Ras El Besh structure drill-stem tested at 612 bbls of oil per day. A well on the Jawhara structure tested at 1,200 bbls of oil per day, and another on the Salloum structure tested at 1,800 bbls of oil per day. None of the projects were pursued at the time by the respective operators for a variety of reasons, including low oil prices.Following acquisition of the Permit in 2004, APEX acquired a high density/high definition 3-D seismic program over nearly 400 square kilometers of the Permit, which included the known Ras El Besh and Jawhara oil pools. The new seismic data has provided a much improved picture of the underlying structural geology of both areas and will allow optimal placement of future wells, thereby maximizing ultimate recovery of the resources they contain.  The Sfax Permit's large size (>4,000 square kilometers) and an enhanced understanding of the prospectivity of the permit facilitated in part by a better understanding of the geologic secrets of the area which were revealed by the new 3D survey, led APEX to seek additional participation in the Permit. APEX was in search of an exploration partner; a company with a strong exploration track record and demonstrated capability that could undertake exploration on the Permit's less developed yet still highly perspective leads.

The Sfax Permit's large size (>4,000 square kilometers) and an enhanced understanding of the prospectivity of the permit facilitated in part by a better understanding of the geologic secrets of the area which were revealed by the new 3D survey, led APEX to seek additional participation in the Permit. APEX was in search of an exploration partner; a company with a strong exploration track record and demonstrated capability that could undertake exploration on the Permit's less developed yet still highly perspective leads.

Anadarko had long been active in Tunisia and like APEX was attracted to investment there because of Tunisia’s history of political stability and solid working relationships with international energy companies. Although Anadarko was attracted to the Sfax Offshore Permit by its prospectivity and high-impact potential, the Production Sharing Contract with the NOC offered good terms by international standards, including accelerated recovery of capital and a fair share of both cost oil and profit oil for the contractor.  In May 2006, APEX and Eurogas, its partner in the Permit, entered into a four-phase farm-out option agreement with Anadarko Petroleum Corporation. The agreement allows Anadarko to earn progressively higher working interests in return for substantial work commitments over a three-and-a-half-year period. On February 17, 2007 Anadarko began a large 3-D seismic survey, which comprised an expensive shallow-water program, covering a planned 420 square kilometers. This project referred to as “KB3D” encompasses a large area and is designed to evaluate several large structures known to exist in the Sfax Permit's northwest portion, southwest of the Kerkennah Islands. The geological targets include the El Garia Formation, plus two secondary objectives, one above in the Reineche Formation, and one below in the Upper Cretaceous Douleb/Bireno Formation. All three are productive in the vicinity.

In May 2006, APEX and Eurogas, its partner in the Permit, entered into a four-phase farm-out option agreement with Anadarko Petroleum Corporation. The agreement allows Anadarko to earn progressively higher working interests in return for substantial work commitments over a three-and-a-half-year period. On February 17, 2007 Anadarko began a large 3-D seismic survey, which comprised an expensive shallow-water program, covering a planned 420 square kilometers. This project referred to as “KB3D” encompasses a large area and is designed to evaluate several large structures known to exist in the Sfax Permit's northwest portion, southwest of the Kerkennah Islands. The geological targets include the El Garia Formation, plus two secondary objectives, one above in the Reineche Formation, and one below in the Upper Cretaceous Douleb/Bireno Formation. All three are productive in the vicinity.

The agreement includes an option for Anadarko to drill two exploration wells. If the seismic results are positive, the first well would be drilled, cased and tested in 2008. Fulfilling all four option phase commitments would allow Anadarko to earn a 75 percent working interest over most of the Sfax Permit excluding areas retained by APEX and Eurogas around the three existing discoveries. |